Humane Society Affiliate Amends Faulty Tax Returns

The Humane Society Wildlife Land Trust (HSWLT), an affiliate of HSUS, has amended its recent tax returns following a complaint we filed with the IRS last year. Our complaint highlighted HSUS’s miscounting of $17.7 million of donated public service advertisements (PSA) under “contributions and grants” on its 2011 tax return—an accounting that artificially inflated its revenue and was in violation of IRS instructions. Because of our complaint, HSUS was forced to issue an amended return with $17.7 million of less revenue for 2011, as well as amend previous returns. All in all, HSUS was left with egg on its face for an embarrassing violation, and potentially the IRS fined HSUS for this transgression (there’s no way of knowing since that information isn’t made public).

The Humane Society Wildlife Land Trust (HSWLT), an affiliate of HSUS, has amended its recent tax returns following a complaint we filed with the IRS last year. Our complaint highlighted HSUS’s miscounting of $17.7 million of donated public service advertisements (PSA) under “contributions and grants” on its 2011 tax return—an accounting that artificially inflated its revenue and was in violation of IRS instructions. Because of our complaint, HSUS was forced to issue an amended return with $17.7 million of less revenue for 2011, as well as amend previous returns. All in all, HSUS was left with egg on its face for an embarrassing violation, and potentially the IRS fined HSUS for this transgression (there’s no way of knowing since that information isn’t made public).

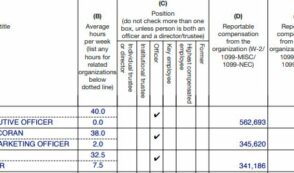

Now HSWLT has done the same. Its 2012 “contribution and grants” were originally declared in a return filed last year to be $11.26 million, but an amended version filed in March declares the figure to be only $7.03 million. The original return lists $4.23 million in PSAs – the exact difference between the two returns – as noncash contributions in violation of IRS instructions. The latter return acknowledges that it was amended to reflect the removal of these “in-kind contributions donated PSAs” that were incorrectly counted in the original filing.

Upon further investigation, HSWLT made the same mistake on its 2011 return, originally listing contributions of $6.94 million in 2011, with $3.83 million listed as PSA donations. In 2010 HSWLT listed $5.20 million in contributions, with $2.84 million of that PSAs donations. No doubt recognizing this was a violation with the IRS after we pointed out the discrepancy, HSWLT issued a revised return removing this PSA income, meaning that contributions fell by more than half to $3.10 million in 2011 ($2.36 million for 2010).

Let’s repeat that—more than half of the Humane Society Wildlife Land Trust contributions have vanished for those years.

Clearly, the HSUS Empire had a systemic problem with artificially inflating its contributions on its tax returns. This tactic makes it seem as though HSUS is spending a lower proportion of its donations on overhead, which can attract donors and raise its score on various charity rating websites, which calculate overhead as a percentage of expenses as part their determinations of charity effectiveness. As we have reported, HSUS gets very poor ratings: “C-“ and “D” grades from CharityWatch in recent years, and HSUS lost a star in its Charity Navigator rating after we exposed this revenue inflation.

Based on HSWLT’s amended tax return, it would probably get an “F” grade. Its 2012 overhead is a shockingly high 64 percent, meaning that only 36 cents of every dollar spent goes to programs. Its amended overhead from 2011 and 2010 tells the same story, at 65 and 66 percent respectively. Clearly now we see why HSWLT had an incentive to inflate its contributions: A desperate attempt to puff itself up.