Charity Watchdog: HSUS Has Violated IRS Rules

We’ve long pointed to the Humane Society of the United States’ deceptive fundraising and poor marks from charity watchdogs, HSUS defending in a RICO lawsuit, and Members of Congress calling for a federal investigation of the group. It now appears that HSUS has filed years of incorrect tax returns with the IRS.

We’ve long pointed to the Humane Society of the United States’ deceptive fundraising and poor marks from charity watchdogs, HSUS defending in a RICO lawsuit, and Members of Congress calling for a federal investigation of the group. It now appears that HSUS has filed years of incorrect tax returns with the IRS.

Today, Bloomberg News reports on a complaint we have filed against HSUS with the IRS, citing an accounting practice that inflates HSUS’s contributions—namely, counting donated air time as contributions. We first exposed this in July, and we have company in our concern. Bloomberg quotes a Minnesota lawyer who specializes in nonprofit tax returns who says HSUS should not be doing this practice, calling it “a relatively elementary rule.” And CharityWatch, formerly known as the American Institute of Philanthropy, is an independent charity watchdog that, in its latest report, also takes issue with HSUS’s accounting, saying it’s a big no-no (emphasis added):

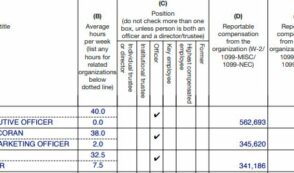

HSUS produces and distributes public service television, radio, and newspaper announcements about companion animal and wildlife issues. This airtime and ad space is donated to HSUS free of charge. The charity estimates the value of these in-kind donations and records it as contributions and expenses in its tax filings. This has the effect of making HSUS appear to be a more efficient fundraiser since the value it places on the PSAs increases its reported annual donations. It also makes HSUS appear to be spending more on its programs since the value of the PSAs is included in program expenses on its tax forms. HSUS’s reported value of these donated PSAs, according to its tax forms, has increased from approximately $4.3 million in 2009, to $15.7 million in 2010, to $17.7 million in 2011. There is just one problem. Reporting donated PSAs in the financial statements of charity tax filings violates IRS reporting rules.

In fact, CharityWatch writes that HSUS’s spending on charitable programs is “much less efficient than what HSUS claims on its website.” No kidding. CharityWatch analyzes charity tax returns and tosses aside the accounting tricks to get down to how efficient a charity is. CharityWatch gives HSUS a “C-minus” grade—which, while a slight improvement over the “D” that HSUS has earned over the past two years, would still get a kid grounded by his parents.

And as for that whole “violates IRS reporting rules” thing, we figured the IRS might want to know about it. So we told them. We sent the IRS a letter laying out the evidence according to the IRS’s own instructions for completing a tax return. The evidence is pretty clear-cut to us; the IRS says that “Contributions do not include… Donations of services (such as the value of donated advertising space or broadcast air time).”

The only person it doesn’t seem clear to is Ken Berger, the head of Charity Navigator, a nonprofit rating service, who tells Bloomberg that HSUS’s violation is a small matter, “if it is an error.” If? It’s really embarrassing for the head of a charity evaluator to not even know the rules about filling out tax returns, which his own organization relies on for evaluations. But such incompetence is par for the course at Charity Navigator. Charity Navigator also overlooks an accounting trick—a legal one, but misleading—that allows HSUS to count fundraising costs as “program expenses,” which gives HSUS a higher score at Charity Navigator by making it seem more financially efficient. Tens of millions of dollars are shuffled around in this way for HSUS, and Charity Navigator looks the other way and gives HSUS a “four-star” score.

That’s not such a small matter now, is it?

And since Charity Navigator does dock the ASPCA and other charities for doing the same thing, the fact that it doesn’t do likewise for HSUS makes us wonder if there’s some funny business going on.

According to the IRS, if HSUS has filed incorrect tax returns it could be fined up to $100 per day, up to $50,000, per return—or close to $200,000 for these four years of filings. We’ll let you know if we see HSUS filing amended returns. And we’ll be curious to see if HSUS chooses to count donated PSAs as contributions on its 2012 return. We will know very soon.