Did HSUS Mislead its Insurance Company or a Federal Court?

The Humane Society of the United States (HSUS) is still facing blowback from the more than decade-long litigation drama involving several animal rights group, including HSUS, and their alleged racketeering scheme against Feld Entertainment, owner of the Ringling Brothers and Barnum & Bailey Circus. The latest issue? Whether HSUS misled its insurance company—or a federal court.

The Humane Society of the United States (HSUS) is still facing blowback from the more than decade-long litigation drama involving several animal rights group, including HSUS, and their alleged racketeering scheme against Feld Entertainment, owner of the Ringling Brothers and Barnum & Bailey Circus. The latest issue? Whether HSUS misled its insurance company—or a federal court.

As readers may recall, a cohort of animal-liberation extremists sued Feld Entertainment, alleging elephant abuse, and lost. Adding insult to injury, however, was the ensuing countersuit. The court found that the activist’s key witness—a former circus employee who lied under oath—had been paid almost $200,000 by the plaintiffs and their attorneys, prompting Feld to bring a federal RICO lawsuit against the animal extremists.

While HSUS was not involved in initially bringing the animal-rights lawsuit against Feld in 2000, the group merged with the Fund for Animals (FFA)—one of the original plaintiffs—in 2005 while the litigation was ongoing. Usually, HSUS has no problem taking credit for the work of its affiliates—except, apparently, when this affiliation involves a federal RICO lawsuit. With racketeering allegations on the table, HSUS was quick to distance itself from the Fund for Animals, insisting that the 2005 marriage did not qualify as a merger.

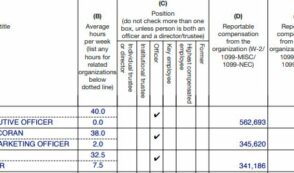

According to HSUS CEO Wayne “I don’t love animals” Pacelle, FFA was separate from HSUS, with “its own board of directors and its own donors.” HSUS filed a motion to dismiss the RICO suit on this premise of organizational separation. According to court records, HSUS argued that while it “join[ed] forces in a corporate combination” with FFA, the two organizations did not merge and therefore HSUS wasn’t liable for any of the allegations. (Never mind, of course, that at least one payment to the witness was made on an HSUS check.)

Before the suit progressed to trial, HSUS joined the other animal radicals in forking over a combined $15.75 million to settle the litigation, covering Feld’s legal fees incurred by the “frivolous and vexatious” 14-year crusade.

HSUS released a statement responding to the multi-party settlement, explaining: “We expect that a substantial portion, if not all, of the settlement costs to The HSUS and The Fund for Animals will be covered by insurance, and in the end, that no donor dollars from The HSUS will go to Feld.”

One problem: HSUS was denied insurance coverage. The solution? Evidently, yet another lawsuit: HSUS sued its insurance provider. But now, it looks like three times won’t be a charm for HSUS.

National Union Insurance Co.—which denied HSUS’s request for coverage—has filed a motion for summary judgment in the suit brought by HSUS. Its motion sheds light on new evidence of glaring factual discrepancies in HSUS’s claims.

A December 2005 insurance application disclosed as an exhibit in the motion asked whether HSUS had merged with any other organization in the past ten years. HSUS answered “yes” and identified the Fund for Animals as the organization and “1/1/05” as the date of the transaction. The application was signed by Wayne Pacelle, and contained a representation that “the statements set forth herein are true.”

To recap, HSUS told a federal court that HSUS and FFA did not merge in 2005. Now, evidence shows that HSUS separately asserted that HSUS and FFA did merge.

By all accounts, there seems to be just two possible explanations: HSUS either misled the court, or misled its insurer. Maybe the several dozen lawyers on HSUS’s staff can try to make a “depends upon what the meaning of the word ‘is’ is” argument, but it seems likely to us that HSUS made the argument to the court because it was more convenient than intellectually honest.

Ethics apparently isn’t a priority at HSUS. After all, this is a group that uses cats and dogs to bring in millions of dollars despite not running a single pet shelter. When will they finally be held accountable?